Needs Analysis

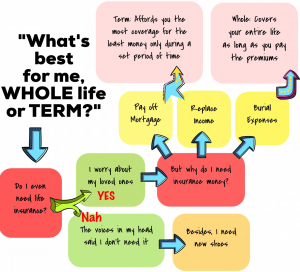

Which of your needs are permanent?

Which are temporary?

Use the right tool for each need

*No medical exams or blood tests, just answer a few health questions online. Get same-day coverage on affordable policies from top-rated carriers in minutes. Term policies ages 18-69. Whole life policies ages 18-85.

Can you remove a phillips head screw with a hammer? Possibly, but would you use a hammer if a phillips screwdriver or, even better, a drill with a phillips bit were available? Financial instruments, just like hand tools, are created with specific purposes in mind, and are typically not a one size fits all solution. Make sure you first understand your needs before deciding on which financial tool to use in addressing them.

How much coverage do you need? It depends, but as a rule of thumb, an average breadwinner with young children will usually need 10 to 15 times their annual income. There are many other potential scenarios and factors, for a detailed approach, please use this Needs Calculator from LifeHappens.org.

Typically, temporary needs such as income replacement (i.e. providing for a spouse to raise children) are best addressed with Term Life Insurance, a temporary and therefore potentially much cheaper product. What is Term Life Insurance? Commonly known as “pure risk” coverage, Term Life Insurance premiums are based on mortality rates (the actual chance that a person your age, gender and with your general health condition and habits may pass away within the policy term) plus carriers’ overhead (remember, insurance companies are “for profit” entities typically responsible to shareholders, and incur significant operational expense).

In short, Term Life Insurance is much cheaper than Whole Life Insurance, and can therefore afford you much larger coverage amounts for a specific period (typically 10 to 30 years), but this coverage does expire at an age when it will be much more expensive to find coverage again.

More permanent needs, like funeral expenses and estate planning, are usually best addressed using Whole Life Insurance, which is usually much more costly than Term Life per thousand dollars of coverage, but does not expire as long as policy premiums are paid. There are even Limited Pay Whole Life Insurance policies which you only pay premiums on for a limited number of years, and provide coverage for life. Of course, the smaller the premium payment period, the higher each premium is.

A key component of Whole Life Insurance, called cash value, is typically designed to reach the policy face amount by the maturity date. For example, a $100,000 Whole Life Insurance policy with a maturity age of 100 is designed to have a cash value of $100,000 when the insured reaches age 100. Cash value is the primary reason why Whole Life Insurance (i) is able to provide lifetime coverage, and (ii) costs so much more than Term Life Insurance per thousand dollars of coverage. A word of caution on cash value: This feature of Whole Life Insurance is not offered in addition to the death benefit. In other words, the $100,000 policy used in the example does not pay you the $100,000 death benefit plus whatever the cash value is at any given time. In fact, if you access the cash value at any point, typically through a policy loan, the benefit paid upon death is reduced by the balance of such loan plus interest. If the loan is not repaid, interest will continue to accrue on the loan at a higher rate than that paid on the cash value, and could potentially terminate the policy if all the cash value is consumed by the loan plus interest.

In short, Whole Life Insurance can provide coverage that does not expire and level premiums, but the cost could prevent you from obtaining sufficient coverage for all your needs.

For many years we have been helping families navigate these choices in order to design the best plan for them based on their unique circumstances and goals. We will be happy to do the same for you and your loved ones.

***This article expresses the views held here at StrongBox, not those of any insurance carrier represented by the author.

About StrongBox Insurance

Our Mission at StrongBox is to help our customers plan intelligently for continuously improved financial health, to protect their most valuable assets, and to provide for their loved ones even in the worst of circumstances.

Each person’s mindset, situation, and circumstances are unique, and so is our approach to each customer. No matter your current situation, we can provide you with profound insight on the options available to help you design an affordable and effective plan to better position yourself and your family in facing life’s surprises with confidence.

According to LifeHappens.org, more than half of Americans think life insurance costs 3x or more than it does, and sure enough, more than half of americans have no life insurance. Please fill out a Quote Request or contact us via phone or email at your convenience, we will be happy to help. You may be gladly surprised about the actual cost of our life insurance solutions.

We are currently focused on solutions through life, accident and cancer insurance products, and anticipate health supplements and property and casualty products to become available in the next year or so.

Life insurance applications are offered through StrongBox Insurance, or through its designated agent only where licensed and appointed. Currently licensed in AL, AR, AZ, CA, CO, CT, DE, FL, GA, IA, ID, IL, IN, KS, KY, LA, MA, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, SC, SD, TN, TX, VA, VT, WA, WI, WV and WY. Not currently licensed in MD, RI, or UT.

904.530.4232

hello@strongboxinsurance.com

PRIVACY: Any health information collected by us requires you to complete a separate authorization. We will not disclose your health information to anyone

without your authorization, unless the law permits or requires us to do so.

Access to your personal information is restricted to only those entities who need it to perform the services required of your policy or account. We have physical, electronic, and procedural safeguards that comply with applicable federal and state regulations to keep your personal information safe. If your policy or account becomes inactive for any reason, we will continue to treat and safeguard your information as described here.